Phishing Scam Tips:

Take the Banks Never Ask That Quiz!

Every day, thousands of people fall victim to fraudulent emails, texts, and calls from scammers pretending to be their bank. As our world becomes increasingly digital, the problem is only growing worse. According to the Federal Trade Commission’s report on fraud, American consumers lost a staggering $10 billion to phishing scams and other fraud in 2023—an increase of 13.6% over 2022!

At River Bank & Trust, we’ve partnered with the American Bankers Association to empower every customer to become experts at spotting phishing scams, and it all starts with four simple words: Banks Never Ask That. By understanding what real banks will never ask for, you’ll be able to easily identify suspicious requests and protect your personal and financial information.

Check out these tips, then take the Banks Never Ask That Quiz for a chance at a $100 Visa Gift Card!

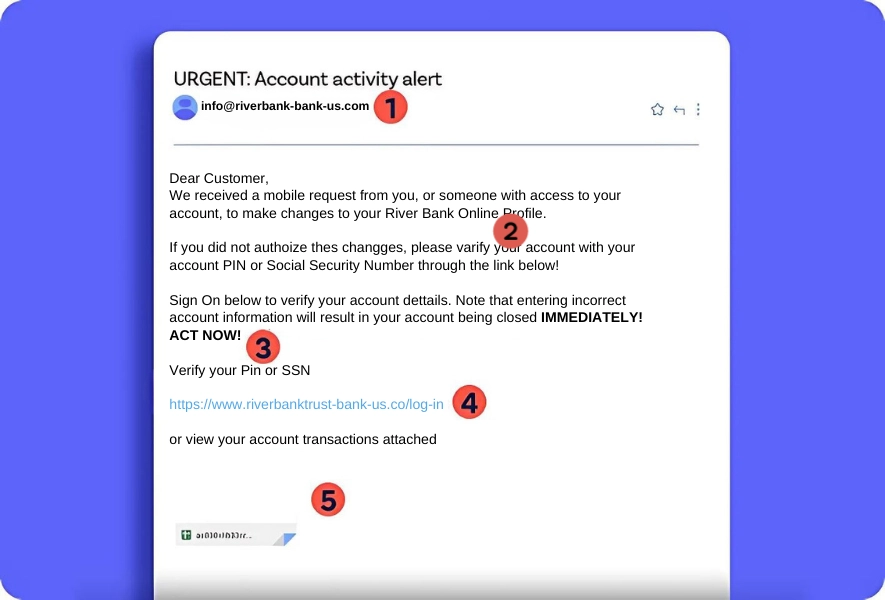

Email Scams

Email scams account for 96 percent of all phishing attacks, making email the most popular tool for the bad guys. Often, the scammer will disguise the email to look and sound like it’s from your bank.

Avoid clicking suspicious links.

If an email pressures you to click a link — whether it’s to verify your login credentials or make a payment, you can be sure it’s a scam. Banks never ask you to do that. It’s best to avoid clicking links in an email. Before you click, hover over the link to reveal where it really leads. When in doubt, call your bank directly, or visit their website by typing the URL directly into your browser.

Raise the red flag on scare tactics.

Banks will never use scare tactics, threats, or high-pressure language to get you to act quickly, but scammers will. Demands for urgent action should put you on high alert. No matter how authentic an email may appear, never reply with personal information like your password, PIN, or social security number.

Be skeptical of every email.

In the same way defensive driving prevents car accidents, always treating incoming email as a potential risk will protect you from scams. Fraudulent emails can appear very convincing, using official language, logos, and similar URLs. Always be alert.

Watch for attachments and typos

Your bank will never send attachments like a PDF in an unexpected email. Misspellings and poor grammar are also warning signs of a phishing scam.

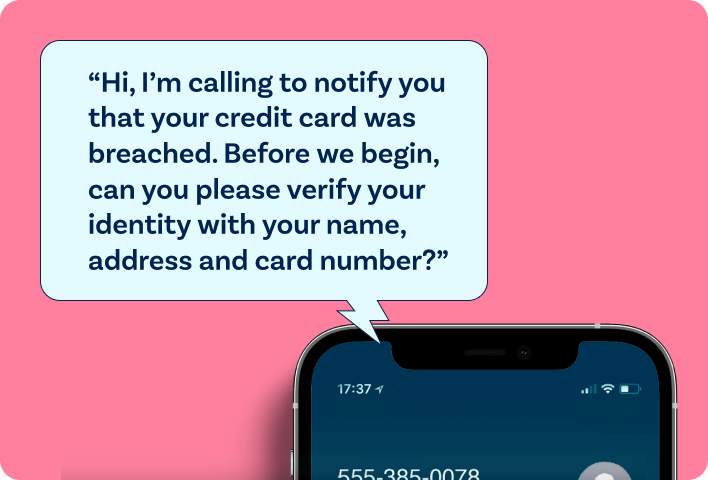

Phone Call Scams

Scammers sometimes try to cheat you out of your money by impersonating your bank over the phone. In some scams, they act friendly and helpful. In others, they’ll threaten or scare you. Scammers will often ask for your personal information, or get you to send them money. Banks never will.

Watch out for a false sense of urgency.

Scammers count on getting you to act before you think, usually by including a threat. Banks never will. A scammer might say “act now or your account will be closed,” or even “we’ve detected suspicious activity on your account”— don’t give into the pressure.

Never give sensitive information.

Never share sensitive information like your bank password, PIN, or a one-time login code with someone who calls you unexpectedly — even if they say they’re from your bank. Banks may need to verify personal information if you call them, but never the other way around.

Don’t rely on caller ID.

Scammers can make any number or name appear on your caller ID. Even if your phone shows it’s your bank calling, it could be anyone. Always be wary of incoming calls.

Hang up—even if it sounds legit.

Whether it’s a scammer impersonating your bank or a real call, stay safe by ending unexpected calls and dialing your local River Bank & Trust office instead.

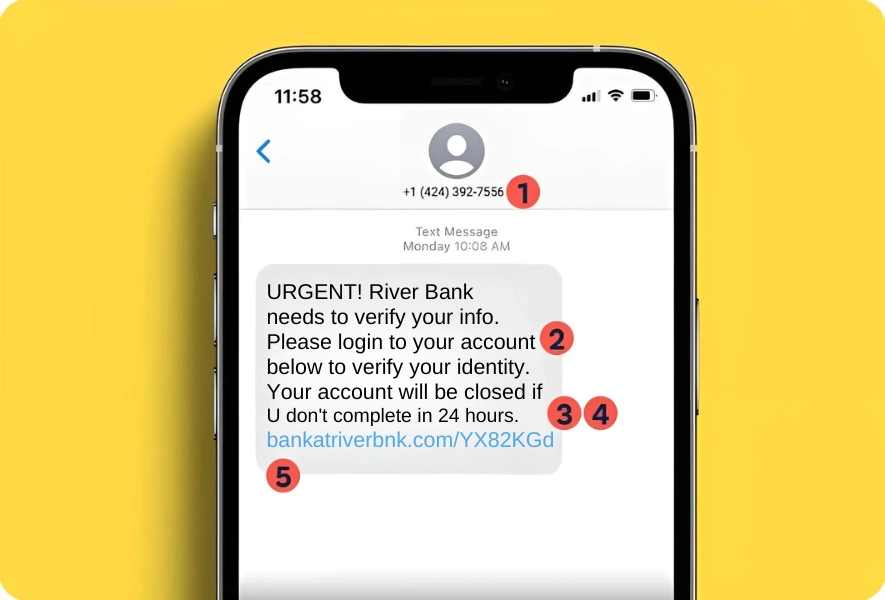

Text Message Scams

Phishing text messages attempt to trick you into sharing personal information like your password, PIN, or social security number to gain access to your bank account. As long as you don’t respond to these messages and delete them instead, your information is safe. All you need to do is spot the signs of a scam before you click or reply.

Slow down—think before you act.

Acting too quickly when you receive phishing text messages can result in unintentionally giving scammers access to your bank account—and your money. Scammers want you to feel confused and rushed, which is always a red flag. Banks will never threaten you into responding, or use high-pressure tactics.

Don’t click links.

Never click on a link sent via text message—especially if it asks you to sign into your bank account. Scammers often use this technique to steal your username and password. When in doubt, visit your bank’s website by typing the URL directly into your browser or login to your bank’s mobile app.

Never send personal information.

Your bank will never ask for your PIN, password, or one-time login code in a text message. If you receive a text message asking for personal information, it’s a scam.

Delete the message.

Don’t risk accidentally replying to or saving a fraudulent text message on your phone. If you are reporting the message, take a screenshot to share, then delete it.

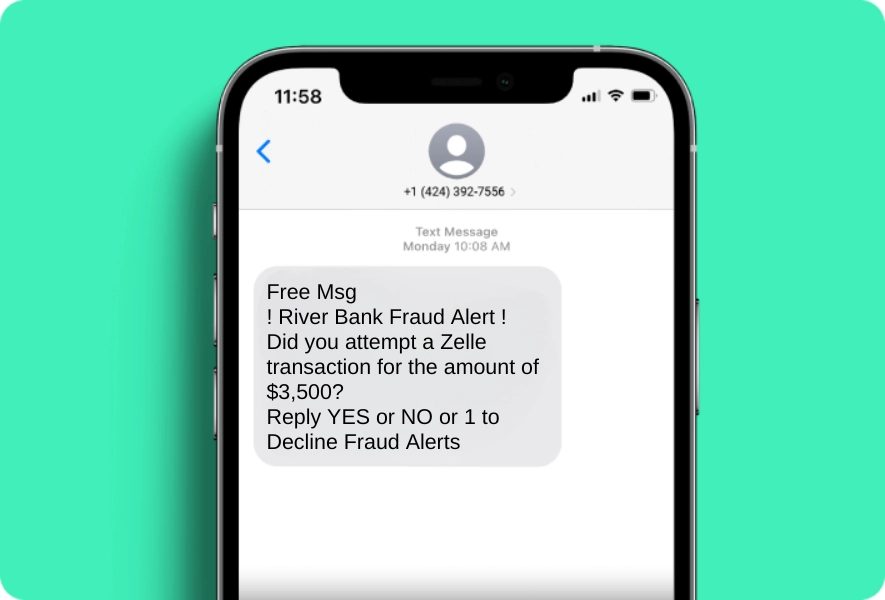

Mobile Payment App Scams

Payment app scams often start with a phone call or text. If you get an unexpected call, just hang up. If you get an unexpected text, delete it. Even when they seem legitimate, you should always verify by calling your bank or payment app’s customer service number.

Use payment apps to pay friends and family only.

Don’t send money to someone you don’t know or have never met in person. These payment apps are just like handing cash to someone.

Avoid unusual payment methods.

Scammers rely on creating a sense of urgency to get you to act without thinking. They might claim your account is in danger of being closed, or threaten you with legal action. These high-pressure tactics are red flags of a scam—a real bank would never use them.

Ready to take the Banks Never Ask That Quiz?

Test your scam-spotting skills by taking the Banks Never Ask That quiz, and as a token of our appreciation, you can enter for a chance to receive a $100 Visa Gift Card!

Please note that the quiz link below will open in a new browser tab or window. Close it after completing the quiz, then return to this page to complete your entry.

Giveaway Rules and Guidelines

Eligibility:

- Who can enter: The giveaway is open to legal residents of Alabama, 18 years of age or older, who are current customers or potential customers of the bank. Employees of the bank, its affiliates, and immediate family members are not eligible to participate.

- Void where prohibited: The giveaway is void in any jurisdiction where such promotions are prohibited by law.

No Purchase Necessary:

- Free Entry Option: Federal law prohibits lotteries. Therefore, no purchase, payment, or bank account is required to enter the giveaway.

Entry Period:

- The giveaway begins on Thursday, October 10 at 08:00 AM and ends on November 7 at 8:00 AM.

- All entries must be submitted by 7:59 AM on the closing date to be eligible.

How to Enter:

- Online Entry: Complete the ABA's "Banks Never Ask That" quiz via the bank's website link. Entrants must provide their contact information, including name, email, phone number, address, and preferred River Bank & Trust location after completing the quiz.

- Mail-in Entry: Entrants may also enter without taking the quiz by mailing a 3x5 index card with their full name, address, phone number, and email address to P.O. Box 680249, Prattville, AL 36068.

Prize(s):

- The prize is a $100 Visa gift card.

- Taxes: Winners are responsible for all federal, state, and local taxes, if applicable.

- No substitution, transfer, or cash equivalent of the prize is permitted unless agreed upon by the bank.

Winner Selection and Notification:

- Winner(s) will be selected by a random drawing from all eligible entries received by the entry deadline. The drawing will be conducted on Friday, November 8.

- Winner(s) will be notified by phone within 5 days of the drawing. The winner(s) will have 5 days to respond. If a winner does not respond within the given time, an alternate winner will be selected.

- The bank reserves the right to disqualify entries that do not comply with these rules or are suspected of fraud.

Privacy Policy:

- The personal information collected from entrants will only be used for the purposes of administering the giveaway, contacting winners, and as otherwise stated in the bank's privacy policy.

- Personal information will not be sold or shared with third parties for marketing purposes.

Publicity:

- By entering, participants agree to allow the bank to use their name, image, and likeness for advertising and promotional purposes without additional compensation, unless prohibited by law.

Limitation of Liability:

- The bank and its affiliates are not responsible for any incorrect or inaccurate information, technical failures, or unauthorized human intervention in the giveaway process.

- Entrants agree to release and hold harmless the bank from any liability, including personal injury or damage to property, arising out of participation in the giveaway.

Compliance with Laws:

- The giveaway is subject to all applicable federal, state, and local laws and regulations, including Alabama's sweepstakes laws.

- The bank reserves the right to cancel or modify the giveaway if fraud, technical failures, or any other factor beyond the bank's control impairs the integrity of the giveaway.

Disputes:

- Any disputes regarding the giveaway will be governed by the laws of the state of Alabama.

- By participating, entrants agree to resolve any disputes individually, without resorting to class-action litigation, and consent to the exclusive jurisdiction of the courts in Elmore County.